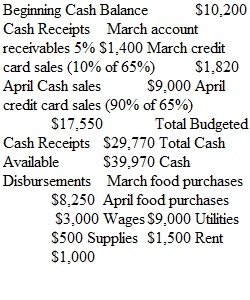

Q Cash Budgeting Worksheet MGT 225 - Managerial Accounting 1. Prepare a Cash Budget for April using info from the Operating Budget, History and Accounting Records given… Cash Budget April, 20XX Beginning Cash Balance Cash Receipts Total Budgeted Cash Receipts Total Cash Available Cash Disbursements Total Budgeted Cash Disbursements Ending Cash Balance Info from April's Accounting Records and History Sales from April = 30,000 and March Sales = 28,000 30% Cash, 5% Accounts Receivable (collected next month), 65% Credit Card (90% collected current month, 10% collected next month) April Food Purchases = 12,000 (25% is paid in month of purchase and 75% paid next month) March Food Purchases = 11,000 All paid in current month: Wages = 9,000, Utilities = 500, Supplies = 1,500, Rent = 1,000 Advertising paid at beginning of year = 6,000, but expensed monthly over 12 months Cash Balance as of April 1st = 10,200 and Bank Loan = 2,500 paid monthly for 12 months beginning in April 2. Prepare a Monthly Cash Budget You have the following information about a restaurant for Year 2019. • Actual Sales Revenue in November was $80,000 • Actual Purchases (cost of sales) in November was $30,000 Sales Revenue will be 40% cash. Credit card sales revenue is 60% of sales of which 96% is collected in the month of sales and the remaining 4% is collected early the following month. Purchases of inventory need to be paid 20% in the month of purchase and 80% the following month. The condensed budgeted income statement is as follows for December, 2018. Sales $75,000 Cost of Sales $29,000 Wages $21,000 Operating Expenses $14,000 Rent $5,500 Depreciation $2,500 Total Expenses $72,000 Operating Income $3,000 The wages and operating expenses need to be paid in December. Rent was prepaid in January for the entire year. The ending balance in November was $4,800. Prepare the cash budget for December 2019. Cash Budget for December, Year 2019 Beginning cash Cash receipts, operations Sales revenue, cash Credit card sales revenue Previous month credit card sales revenue Total cash receipts Total cash available, December 2019 Cash disbursements, operations December cost of sales November cost of sales Wages expense Operating expenses Total cash disbursements Ending cash balance 3.Prepare a three month cash budget using the following information for April-June. • Assume all sales are cash • Annual interest on securities is received in April. Amount = $2,700 • Time delay for paying food and beverage suppliers is one month. • Wages are paid in current month with no time delay. • Other expenses are paid in a one month delay. • Kitchen equipment will be purchased in April and paid for in May. Cost =$25,000 • The beginning cash balance on April 1st is $25,000 Month Sales Revenue Purchases Other Food Beverage Food Beverage Wages Expenses March 32,000 9,600 13,500 3,000 12,500 10,800 April 36,000 11,800 13,900 4,200 14,000 10,900 ay 37,000 12,600 14,000 4,400 14,800 11,200 June 46,000 13,800 14,700 4,800 15,000 11,900 April May June Beginning balance: Cash receipts, operations Food sales revenue Bar sales revenue Cash Available Cash disbursements, operations Cost of sales purchases: Cost of sales, Food Cost of sales, Bar Wages expense Other expenses Total cash disbursements Cash excess (deficiency) Financing Activities Equipment purchased Interest income Ending balance:: 3. 4. Cassidy Tate owns the Huddle House Catering Company. Her clients are routinely billed after their events have concluded and, as a result, Cassidy carries a significant amount of accounts receivable. (Test your Skills 2) Help Cassidy complete the accounts receivable aging report she has begun for her business by filling in the appropriate missing data. Huddle House Catering Accounts Receivable = $250,000 Total Number of Days Past Due Less Than 30 30–60 60–90 90+ $187,500 $37,500 ?Total $187,500 $37,500 ?% of Total 3.0%

View Related Questions